The digital artist known as Beeple sold an NFT for $69 million in cyptocurrency at Christie’s auction in March, 2021. The media treated this grotesque sale as if it revolutionized the art world, but if we separate reality from the hysterical hype, it clearly has not. An NFT stands for a “non-fungible token”—probably the most ridiculous acronym ever invented by digital geeks. An NFT is nothing more than a token on a shared digital ledger in the never-ending continuum known as blockchain. I’m not an expert on blockchain; however, suffice it to say, the owner of an NFT can signify his ownership by obtaining a token, or time-stamp in a digital ledger that constitutes a blockchain.

It’s important not to confuse ownership of an NFT with ownership of a copyright which is governed by copyright law. Common law copyright automatically attaches upon the artist’s creation of the work and statutory copyright is established by a filing with the US Copyright Office. The vast majority of the time when an artwork is sold the artist retains the copyright. The artist may also license the copyright if, for example, he or she wishes to merchandise an artwork’s image.

An owner of an NFT does not own the digital artwork or the copyright that attaches to it (ownership is retained by the digital artist). The buyer simply owns the NFT of the first edition of the digital file, but nothing else. Is NFT a con? I leave it to those who have read about the 17th-century Tulip bulb craze in the Netherlands to decide.

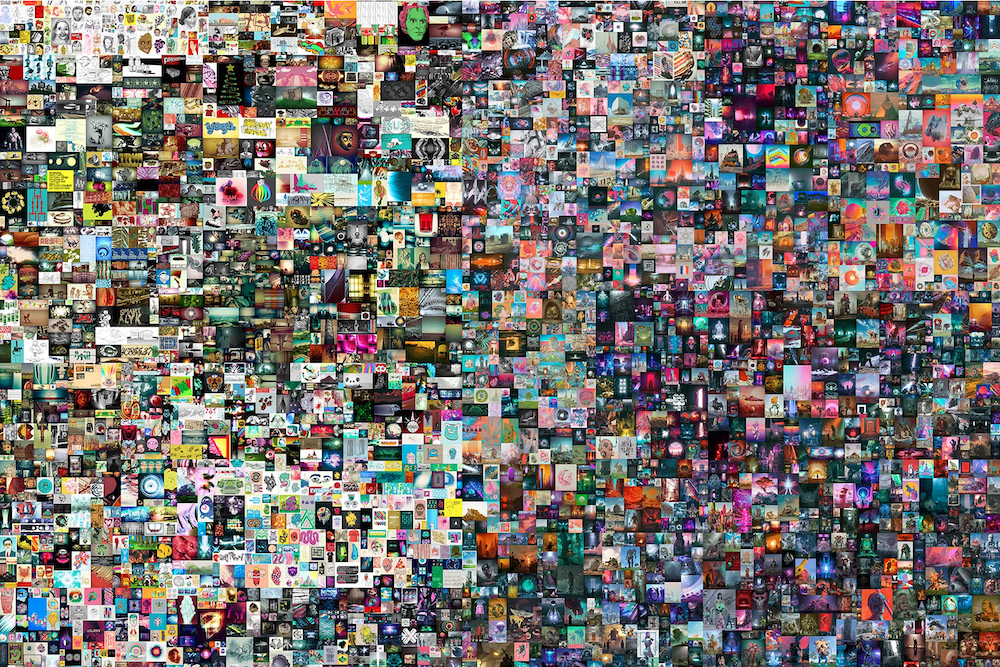

Beeple (Mike Winkelmann) had a successful career as a graphic designer of video games when he decided he would create a new digital image every day for 5,000 days. The digital file which set the record at Christie’s for a NFT contained all of those images and was titled Everydays: The First 5,000 Days. I’m not going to quibble about whether digital art itself is “art.” As far as I’m concerned, it is. The problem is that the NFT of a digital file is a digital ledger entry which does not constitute an artwork.

Over the last few years NFTs have become things of value and can be bought or sold online. In fact, prior to the auction of The First 5,000 Days, Beeple sold numerous NFTs of still digital images he created, as the market for NFTs got red hot. Many of the images making up the The First 5,000 Days and other Beeple digital works are freely available to view online (featured here).

A few weeks before The First 5,000 Days was sold, an NFT of Nyan Cat, a ubiquitous meme of a flying cat with a pop-tart body, was sold by its creator for the equivalent of $580,000 in cryptocurrency. Recently, there has been a frenzy for NFTs of short clips of NBA stars making spectacular dunks or blocks. A digital token of LeBron James blocking a shot went for $100,000 in January. A company called NBA Top Shot has made a market in NFT sports clips achieving $43 million in sales in January, 2021, according to The New York Times.

Stills from Kate Moss’s NFTs.

Anything digital can be an NFT. The Times reports that Twitter CEO Jack Dorsey sold his first tweet for the equivalent of over $2 million in crypto. The insanity reached new heights in April as Vogue reported that super-model Kate Moss said she was selling NFTs labeled “Kate Sleeping” and “Kate Walking”—the proceeds, she says, will be donated to charity.

The art world has already heard from the most mercenary of artists—Damien Hirst and Takashi Murakami declared they would be selling numerous NFTs of images of their works. Many other artists are sure to follow their example.

Christie’s, deeply in on the NFT Beeple hype, clearly wants to establish a category of NFT auctions capitalizing on the craze. Christie’s proudly announced that the sale of The First 5,000 Days would be made in crypto—specifically in Ethereum—the second largest cryptocurrency after Bitcoin, both of which have hit recent market highs. This was the first auction where Christie’s accepted crypto for payment, including the buyer’s premium.

The buyer of The First 5,000 Days, billionaire Vignesh Sundaresan, who calls himself Metakovan (described by the media as a cryptocurrency “whale”), is the founder of Metapurse, an equity fund for cryptocurrency. Paying in crypto for his auction purchase helped bring legitimacy to Ethereum and other such currencies.

Metakovan (does anyone use their real name in this “brave new world?”) plans to build a digital museum to display his collection of NFTs. He has also established a “public art project” known as B.20 (it contains certain Beeple NFTs Metakovan purchased in December, 2020 for $2.2 million) The Times reported that Metakovan has been selling millions of fractional shares (“tradeable virtual tokens”) in B.20—so he’s no fool.

Neither is Beeple. Shortly after the sale to Metakovan, it was reported that Beeple converted all of his Ethereum into millions in good old US greenbacks, as the saying goes: “Trust your mother but cut the cards.”