Eth, bit, sol, meta, block chain, bored apes, crypto punks, kitty litter squad, non-fungible, minting, mining, tokenizing, gas fee, hot wallet, cold wallet, generative NFT, destructive NFT, candy machines, early adopters—yes this is English—just not the English of our youth or even the English of a few years ago. This is the contemporary language of commerce and the new verbiage for the art world to understand. If you don’t know what this means, start googling, because the ship has left the dock and you are waving goodbye as everyone else is already on the Open Sea.

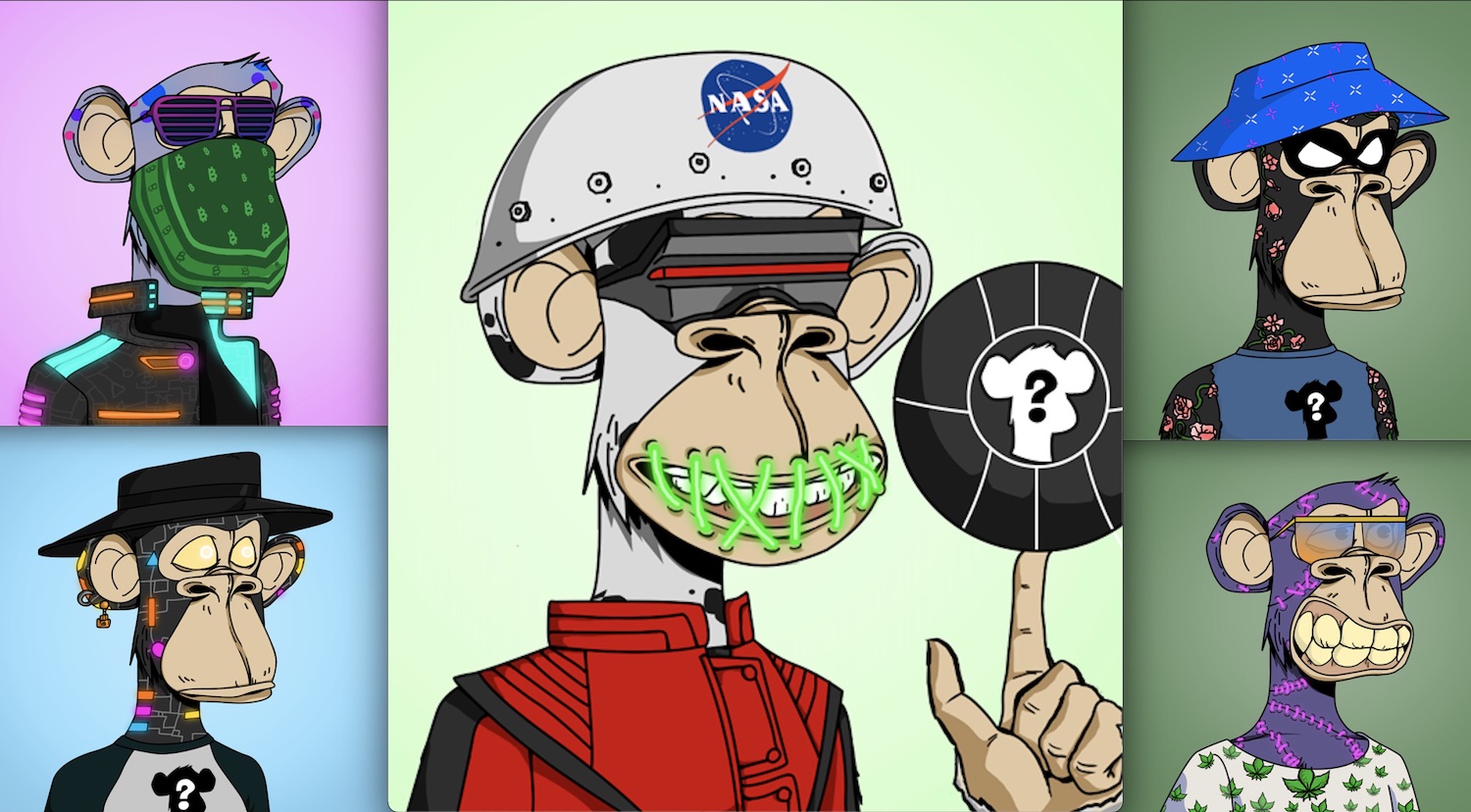

Even a goofy ape with a hipster hat from a derivative collection can get a cover shot these days. If you braved the Omicron variant to be at Art Basel, you know that major galleries are moving from brick and mortar to the metaverse. Artists are no longer producing works with classical materials such as paint, bronze and photography but rather with AI algorithims, generative layers and 3D models. Art editions have somehow ballooned from 3+2AP’s to a 5,000 unit drop. And guess what, they cost more for 1/5000 than 1/3.

Crypto is no longer a speculative fiscal structure that exists only in the arena of the cyber elite, it is something that is bought and sold everyday—even by yours truly—on the coinbase app simply a cell phone thump away. The NFT world has brought a whole new type of collector into the speculative art world: a collector who is digitally wealthy, crypto-swole, and has very few places to spend that wealth.

If you were one of the smart (more so lucky) ones that spent a couple hundred bucks and bought in at the start of Bitcoin or Ethereum, you are now sitting on a hot or cold wallet with many many more zeros behind the one. Why sit there looking at your imagined digital $ that’s going to fluctuate, why cash out and pay taxes? In classic Buffet strategy—diversify your portfolio. What that means is, buy a pesky penguin, get some generative NFTs from your favorite artist, or buy a soon-to-be-minted farting cat from the Kitty Litter Squad. It is as if we have stepped through a tiny hidden door in the back of the blue-chip art-world space and have now walked directly into Willy Wonka’s factory. All is possible: you just need to mint it.

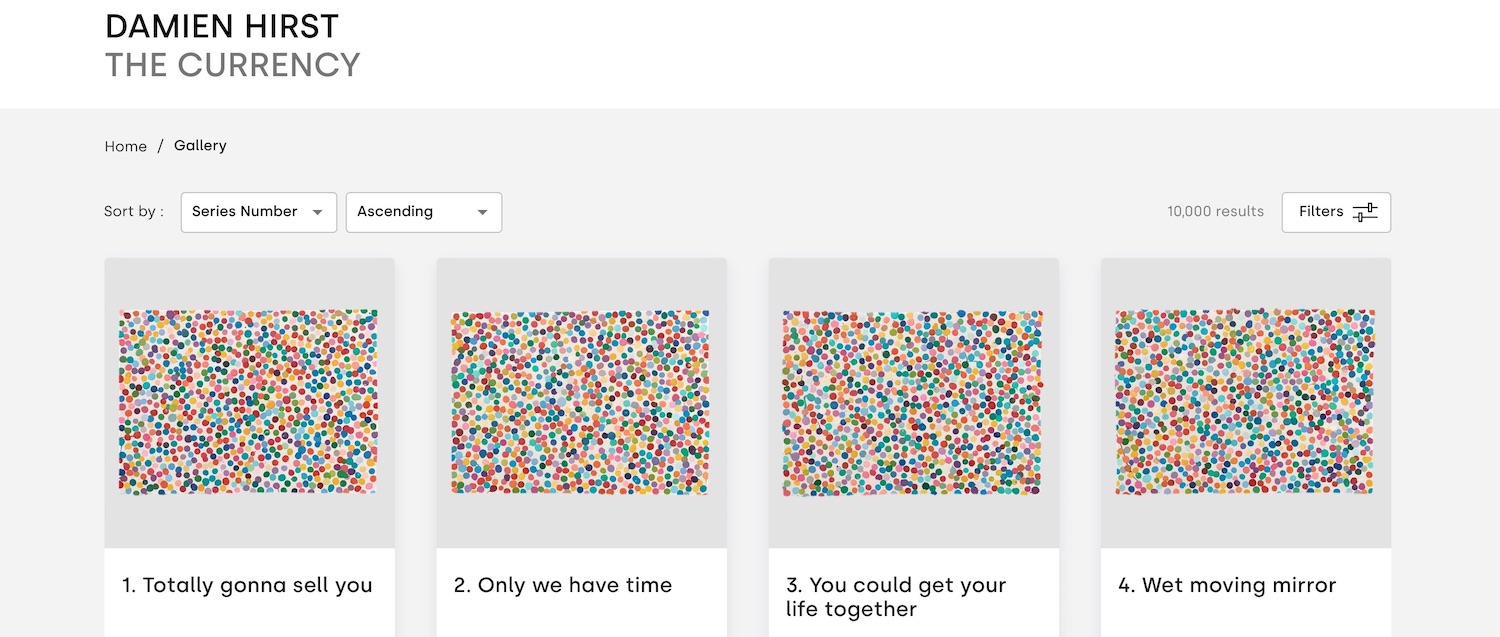

Online gallery of Damien Hirst’s “The Currency:” A collection of 10,000 unique NFTs that correspond with original artworks, which the collector can choose to exchange with the virtual NFT for after its acquisition.

Much of the new pseudo-art that is taking over the NFT platform is being made by artists or collectives previously unknown to the general canon or common discourse—but does that matter? Sure, the art world elite (e.g., Damien Hirst) has a foothold in the NFT space, but what is a Beeple, a Bored Ape, or most importantly, what is generative art?

To all of these questions, there is a simple answer: those of us entrenched in the world of art understand that the rules were thrown out long ago—why ask so many questions? We are not some old man yelling at the kids to get off our lawn. Art is about taking new ideas to the limit, breaking the rules, and creatively making it up as we go along—cut up a shark, paint a lily pad, cover yourself in ketchup and cut a giant finger off, or maybe an ear—bring on the chaos.

The NFT world is no different; it just came out of left field and sucker-punched the traditional art world as COVID stole our focus. No one saw it coming—well maybe gamers, but the last two years were a perfect storm to launch the crypto-fueled NFT market. COVID, skyrocketing prices of digital coins, and the whole world locked in front of computers tinkering when they were supposed to be on a Zoom meeting. A Hollywood writer couldn’t have scripted this monumental change more perfectly. Regardless, we are here and it is not going away any time soon. (Even a goofy ape with a hipster hat from a derivative collection can get a cover shot these days.) So either find your digital footing or sit on the porch yelling at the kids.

Honorary Bored Ape #19 by BoredApeYachtClub (BAYC): an NFT collection of 10,000 original Bored Ape NFTs.

Those previously established/successful/traditional blue-chip artists will always have a seat at the table, but they are being moved from first class to coach. A new class of artist is in town and, interestingly enough, many have never been successful in the traditional market, yet their NFT collections “mint out” in a matter of minutes for a cool couple of million dollars. As the time of papacy-ruled art wanes, Gagosian has given way to pixelized NFT collections that sell for much more and don’t need locations in Beverly Hills, Paris and Park Avenue.

Where will this end? It is currently boundless, with one of the paramount aspects to this revolution being that NFTs actually protect the artist. The wealthy have always been sheltered by their curated collections and set auction prices. The blockchain is the ultimate equalizer; true provenance and the smart contract is the one time in history when an artist can not only formally show that what they have created is original and unique, but can also collect royalties on secondary market sales. No longer is it only the whales that get whalier, our people—the creators—finally have protection in this new metaverse of art.