The art world has been a secretive, opaque business for centuries. Secondary market transactions are rarely transparent and auction houses are often silent about the identity of the ultimate seller and buyer (provenances are full of phrases such as “from a private collection”). The use of intermediaries and straw buyers is routine. The last decade has seen the rapid growth of international freeports providing tax-free transfers of art between wealthy individuals who, in many cases, do not even take possession of the artwork.

The US and the EU have levied sanctions against a large number of oligarchs, primarily Russian. To evade these sanctions, oligarchs have turned to money laundering which essentially paid for the so-called “billionaires’ row”—super-tall condo towers on New York’s 57th Street. These multimillion-dollar condos were almost always bought and paid for by shell companies based offshore. The use of shell companies has become common in transactions by both buyers and sellers of major works of art. The FBI discovered that some oligarchs who were evading sanctions turned to the art business for sanctuary over the last decade due to more transparent disclosure laws in the real estate business.

The $65 billion-per-year art business has been labeled “the last major unregulated market.” But things may be about to change big-time for dealers and collectors. The US Senate Permanent Subcommittee on Investigations held hearings last year entitled “The Art Industry and US Policies that Undermine Sanctions.” The committee did a case study of two sanctioned Russian oligarchs who hid their identity by using an art advisor to buy art at auction and found that despite the auction houses’ claims of transparency, these houses did indeed facilitate secrecy in transactions.

The Senate committee concluded: “There is currently no regulation that specifically targets money laundering in the art market, nor does the art market itself subject professional art intermediaries to any standards of professionalism that directly address money laundering.”

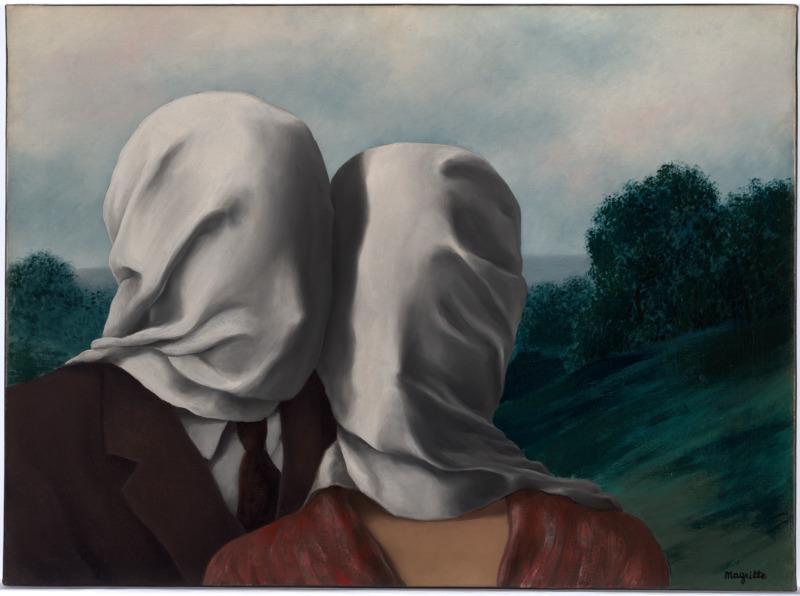

René Magritte, Les Amants, 1928

The Bank Secrecy Act (BSA) was enacted in the 1970s to curb money laundering. It mandates that financial institutions must report all cash transactions of $10,000 or greater. The institutions are required to file suspicious activity reports (SAR) if the transactions indicate possible violations of laws or regulations. The art industry has not been subject to the BSA.

This January, Congress passed legislation to make the anti-money laundering (AML) regulations applicable to antiquities dealers (the concern was smuggling of relics from war-torn Iraq and Syria). The legislation directed the Treasury Department to study whether the AML regulations should also be extended to the art market as a whole.

The EU and the UK have recently passed laws requiring dealers and auction houses to determine the true identity of their clients and report suspicious activity. The major auction houses that have substantial business in Europe claim they are now complying with the new regulations and are requiring full disclosure of counterparties and are applying these new rules to US auctions voluntarily. Nevertheless, it seems likely that the Treasury Department will extend the BSA and AML regulations to cover private dealers and auction houses in the near future. A host of new record-keeping and reporting obligations may be imposed on art dealers—few of them ready for it.

ARTnews reports that the Art Dealers Association of America has been working with Congress to ensure that regulations are reasonable and don’t impose an “undue burden” on dealers. Hopefully, the ADAA will convince legislators that most money-laundering occurs at the high end of the art market. New regulations should either exempt or limit the obligations of increased reporting and record-keeping for smaller galleries that deal primarily with emerging artists.

Currently, the capital gains tax rate on profits from art sales is higher than that for transactions in financial markets and real estate, which are subject to 15 to 20% rates on long-term gains. Profits from art sales are categorized as sales of collectibles and are taxed at a maximum rate of 28%. I believe if art is to be treated similarly to an asset class such as financial instruments and real estate, then it should receive equally favorable capital gains treatment. Lowering the capital gains tax on art profits would be a way of balancing the burden of the reporting requirements that may be coming soon to a dealer near you.